Quick Fix 4 Administration of the VAT identification number Baker Tilly

VAT registration or TIN number is a mandatory and important process for all traders or businesses who are actively involved with manufacturing or even in the sale of goods and products. VAT is quite similar to Sales Tax but it's quite different from sales tax considering that it is collected once at the time of purchasing.

Tax Identification Number Malaysia FIRS issues deadline for taxpayers to obtain Tax

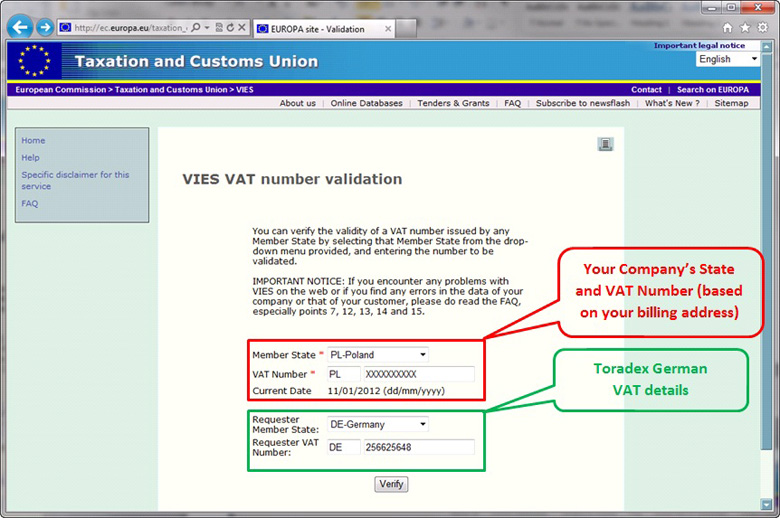

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

What is a VAT identification number? Virtual office

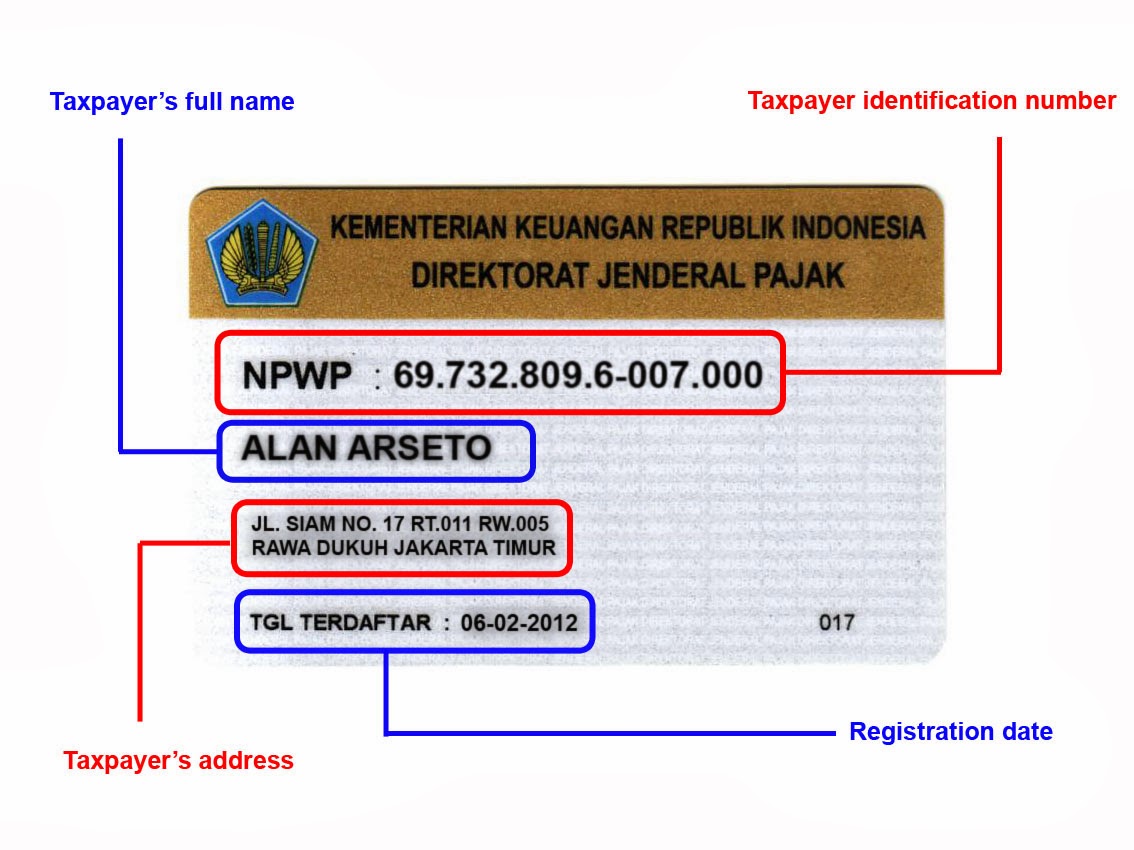

Taxpayer Identification Number - TIN/VAT The full form of TIN is Taxpayer Identification Number, it was previously known as the VAT/CST or Sales Tax number. This number comes directly from the Commercial Tax Department and helps in identifying individuals and companies who pay commercial tax to a State government.

How do I update my VAT registration status and VAT number? Artfinder Seller Support

When registered for VAT, the manufacturer or trader is allotted a unique 11 digit number which will serve as the VAT Number / TIN Number / CST Number for the business.VAT / TIN / CST utilize the same unique 11 digit number. Therefore, VAT / TIN / CST are the same and obtaining VAT Registration from the State authorities will suffice as the TIN.

VATnumber. What is that and how to get it? CloudOffice

The TIN full form is Tax Identification Number (TIN) which is an eleven digit number assigned to every business registered under VAT. The first two characters of the TIN represent the state code and the rest nine digits vary from state to state.

What Is Vat Number In Malaysia / Meet Liong, the Only M'sian Chinese Who Made the Cut in A

TIN, or Taxpayer Identification Number, is a unique identification number required for every business enterprise registered under VAT. It is typically contains 11 characters out of which the last two depict the state of the applicant and is provided by the IT department to all the business entities willing to register under VAT or CST.

Validate Vat Registration and Tax Number 1 for EU countries SAP Blogs

Learn about VAT within India. Find out which goods or services are liable to VAT, when to register and how to pay VAT. Get VAT news in India. Skip to main content +44 (0) 1273 022400;. Get EU VAT number; Help with VAT returns; Contact Us +44 (0) 1273 022400; Monday - Friday 8:00am - 6:00pm;

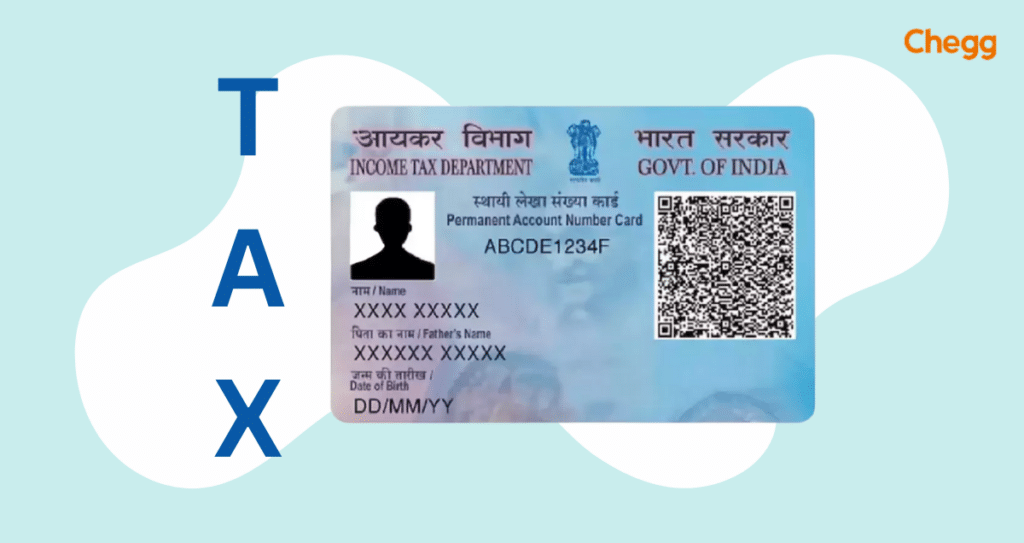

Tax Identification Number India How to Apply for a TIN Online?

The Value Added Tax Identification Number (VATIN) is a unique identifier used by many countries to identify entities for Value Added Tax purposes. These identification numbers are mostly numeric digits beginning with a 2-letter country code. VAT-registered businesses are required to collect VAT from their customers and return it to the.

Toradex How to validate the EUVAT number?

To make an application for Tax Identification Number, follow the steps mentioned below. Step 1 - Sign in to the VAT portal of your state with a unique login ID. Step 2 - Fill in the application form on the portal with the necessary details and upload the documents. Step 3 - This application will be verified by the commercial tax department of a.

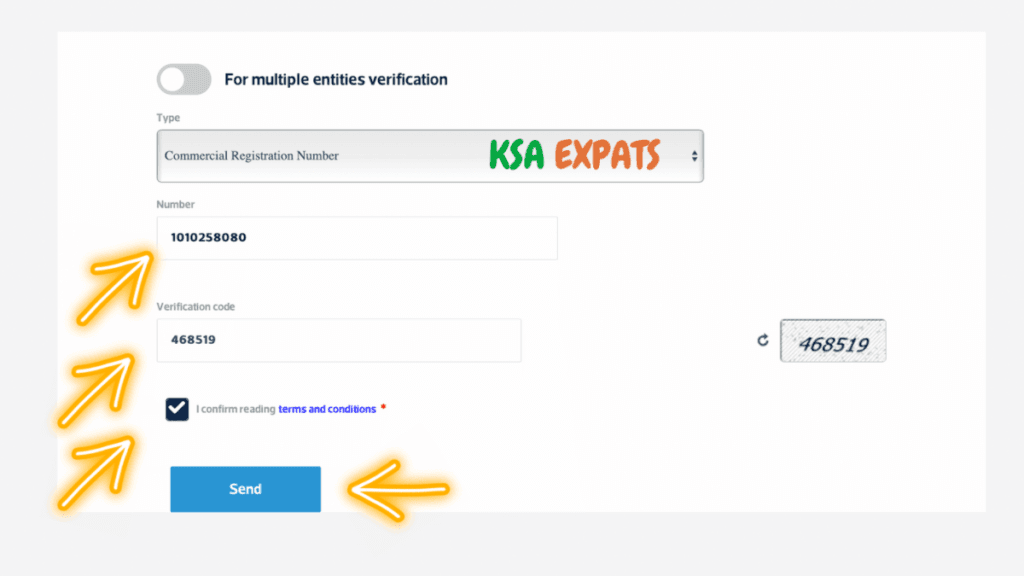

How To Find VAT Number In Saudi Arabia

Introduction (Value Added Tax) Additional instructions dated 9th June 2009 on VAT Compensation. VAT Compensation Guidelines dated 19th July 2005. Description: Department of Revenue functions under the overall direction and control of the Secretary (Revenue). It exercises control in respect of matters relating to all the Direct and Indirect.

Verification of Russian VAT identification numbers VATupdate

How to know the TIN application status? FAQs What is TIN number in India? The Taxpayer Identification Number, commonly referred to as TIN, serves as a crucial and distinct identification code for every business establishment that is officially registered under the Value Added Tax (VAT) system.

VAT identification number cos'è come funziona, quando, a cosa serve

What is the procedure of VAT registration? 1. Submit an application for VAT in Form 1 along with the following documents to the local VAT office: Copy of important documents such as the address proof, ID proof of the Proprietor/Partner/Director. PAN number. & Bank Account No of the Proprietor/Partner/Director.

India VAT Number Checker Android Apps on Google Play

Value Added Tax or VAT is nothing but a levy that was established by the Indian Government (the Central Government) in the early 2000s. The VAT and service tax have now been replaced by the uniform tax regime the Goods and Services Tax (). Value Added Tax is valid tax levied by the Central Government on the value added to a product or services before reaching to the final customers.

How VAT works and is collected (valueadded tax) Novashare

VAT Number Formats.. (VATIN) as TIN (Tax Identification Number), TRG (Tax Registration Number), or GSTIN (Goods and Service Tax Identification Number). The format may be different depending on the country. It usually begins with a country identification code, followed by a series of digits and sometimes letters.. India: 1234567890123Z1.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

The procedure for applying for a Tax Identification Number India is outlined below -. Go to the site of your state government and register for the VAT portal. After completing, log in to the online portal. Fill out the TIN registration form on the portal with the essential information. Attach all supporting documentation.

VAT ID All information about the VAT identification number Blister Magazine

A VAT registration number is alphanumeric and consists of up to 15 characters. The first two letters indicate the respective member state, for example DE for Germany. When entering your VAT number, it must include the two letters that identify your EU member state (e.g. DK for Denmark, EL for Greece, and GB for the United Kingdom).