Dave Ramsey Baby Steps PDFs (Dave Ramsey Baby Steps Printables) A Mom

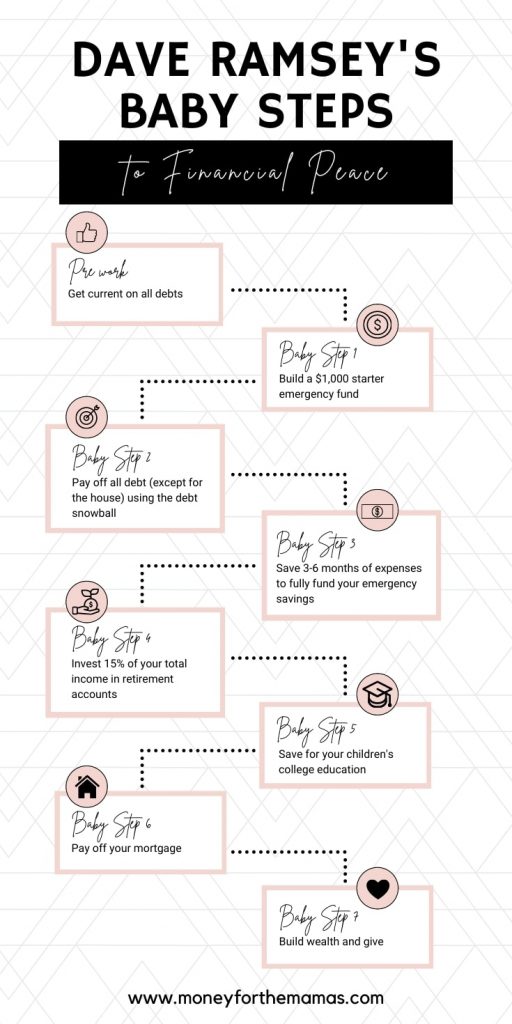

Baby Step 1 - Save $1,000 for your starter emergency fund. Baby Step 2 - Pay off all debt (except the house) using the debt snowball. Baby Step 3 - Save 3-6 months of expenses in a fully funded emergency fund. Baby Step 4 - Invest 15% of your household income in retirement. Baby Step 5 - Save for your children's college fund.

dave ramsey seven baby steps pdf Lorna Mcbee

Dave Ramsey's 7 Baby Steps - Ramsey Find Out Which Step You're On Step 1: Save $1,000 for your starter emergency fund. Step 2: Pay off all debt (except the house) using the debt snowball. Learn More Step 3: Save 3-6 months of expenses in a fully funded emergency fund. Learn More Step 4: Invest 15% of your household income in retirement. Learn More

dave ramsey baby steps Financial peace, Dave ramsey financial peace

The Seven Baby Steps - Begin your journey to financial peace Baby Step 1 - $1,000 to start an Emergency Fund An emergency fund is for those unexpected events in life that you can't plan for: the loss of a job, an unexpected pregnancy, a faulty car transmission, and the list goes on and on.

Dave Ramsey's Baby Steps and Why They Work [2020 Update]

Pay off your mortgage. Build wealth and give money to charity. If you're looking for a way to track your progress throughout each baby step: Here's a Dave Ramsey Baby Steps Tracker. It's a printable PDF. There are color and black & white options. If you're interested in purchasing this printable, you can click here to get a 15% off coupon.

Dave Ramsey’s Baby Steps How Do It Info

Ramsey Solutions has taught financial principles for 30 years. This includes what is called the 7 Baby Steps. These are steps performed one at a time, in their respective order, to obtain what we call financial peace. Baby Step 1: Save $1,000 for Your Starter Emergency Fund In this first step, your goal is to save $1,000 as fast as you can.

Dave Ramsey’s 7 Baby Steps Explained GirlTalkwithFo

The Total Money Makeover Book Dave has authored several bestselling books, but his book The Total Money Makeover (TMM) has been pivotal in many people paying off their debts and beginning their debt free journey. In TMM, he outlines his seven baby steps in great detail. If you only get one of his books, it should be this one.

The Dave Ramsey Baby Steps UK Version Wanna Be Debt Free

Ramsey's 7 Baby Steps Ramsey Newsletter Real Estate. Mortgage Calculator. This form outlines Dave's recommended percentages for each category, making it easier to set up your budget. Download Major Components of a Healthy Financial Plan

Dave Ramsey's 7 Baby Steps

Baby Step 1: Ramsey's first step is to save $1,000 for your starter emergency fund. Baby Step 2: Ramsey's second step is to pay off all debt (except your mortgage) using the debt snowball method. Baby Step 3: Ramsey's third step is to save three to six months of expenses in an emergency fund.

The Dave Ramsey Baby Steps

If you're following Dave Ramsey's 7 Baby Steps, you know that Baby Step 2 is to pay off all debt (except your house) using the debt snowball. So, once you're current on all your bills and have $1,000 saved for your starter emergency fund, it's time to get that snowball rolling! How Does the Debt Snowball Method Work?

The Good, Bad & the Ugly of the Baby Steps by Dave Ramsey MFTM

The 7 Baby Steps Explained - Dave RamseyNix the guesswork and scrolling. We'll connect you with investment pros we trust: https://bit.ly/3hc6PgtVisit the Dav.

Basic Overview of Dave Ramsey’s 7 Baby Steps HassleFree Savings

Baby Step 1: Save $1,000 for Your Starter Emergency Fund Only 32% of Americans say they can pay cash for a $400 emergency. 1 That means 68% of them are borrowing, selling or going into debt when life happens. And it does. Your car's catalytic converter gives out. Your kid busts his chin and needs stiches from the ER.

The Dave Ramsey Baby Steps UK Version Wanna Be Debt Free

Baby Step 1: Your Budgeting Guide 18 Min Read | Oct 25, 2023 By Rachel Cruze New to budgeting and on Baby Step 1? We're so glad you're here! This guide will help you start your first monthly budget. Right now, you're trading the short-term rush of immediate gratification for the peace of financial success over the long term. And that's hard work.

Dave Ramsey Baby Steps Pdf Download

What are the 7 Baby Steps? 3 months ago Updated You win with money the same way you learn to walk one step at a time. That's where the 7 Baby Steps come in. Here's the process: Baby Step 1: Save $1,000 for Your Starter Emergency Fund In this first step, your goal is to save $1,000 as fast as you can.

Pin on Saving Money Tips

What Is Dave Ramsey Baby Step 1? Dave Ramsey Baby Step 1 is to begin a starter emergency fund of $1,000. The money should be easily accessible (like a separate checking, savings or money market.

Dave Ramsey's Seven Baby Steps Explained

Built with ConvertKit Are Dave Ramsey's Baby Steps the Right Financial Plan for Large Debt? The Dave Ramsey plan is not for me. I make a large income. I can afford a car payment, a nice house, and I totally deserve those cute shoes I saw yesterday. These are a few things I used to tell myself. I now realize they were keeping our family crazy broke.

Are you looking for a free debt snowball worksheet to follow Dave

Microsoft PowerPoint - GACTE Presentation.07.12.11.FINAL.ppt [Compatibility Mode] spending 7 years as a teacher and corporate trainer for various organizations. Christy graduated magna cum laude from Duke University with a B.A. in English. [email protected] 800.781.8914 ext. 5259.