Just a Member Chip Filson

Chip Filson is calling for credit unions to embrace their cooperative structure and to raise their voices about the process for making NCUA regulatory appointments. Just before the GAC's opening.

Just a Member Chip Filson

Chip Filson is a co-founder in1985, with colleagues Bucky Sebastian and Ed Callahan, of Callahan & Associates, Inc. from which he retired in 2019. The three partners had worked together as state.

Tight Final Four Round Two Races CUTimes25 Credit Union Times

Chip Filson's Post Chip Filson Blogger at Just A Member - chipfilson.com 11h Report this post A new cohort is taking over. Thank goodness! Bringing the Next Generation into Leadership.

BAysaqXnZsy2wgCSI4Ce6I0roJAalT5ttFP4wZC8wp_e2J2GtQkP

By Chip Filson, John Pettit Verified, Bo McDonald, Patty Corkery | CUInsight.com Verified. Often, outsiders offer fresher insights into what makes credit unions special than found in the industry's own internal coverage. Next City is a digital journalism site that provides innovative examples of individuals and organizations confronting the.

Wood Chip Free Stock Photo Public Domain Pictures

This commentary is by Chip Filson, who was supervisor of Illinois credit unions, director of the office of programs for the federal credit union regulator, and then president of the Central.

Lululemon founder Chip Wilson wants board shakeup Marketing Magazine

In the first three months Xceed reported the following: a loss of $2.1 million (ROA of -.87), a 22% drop in loans ($146 million), 11% share growth, 112% operating expense/total income ratio, net worth of 11%, a 9.2% decline in members and 19% fewer employees (35 out of 185 have left) both compared with one year earlier.

Wood Chip Free Stock Photo Public Domain Pictures

Chip Filson is a co-founder of the Co-Ops 4 Change movement. He is also a co-founder of Callahan & Associates and currently serves as the company's chairman of the board or directors. A nationally recognized leader in the credit union industry, Chip is a frequent speaker and consultant for the credit union movement..

Filson Summer Packer Hat

Posted on February 19, 2021 February 18, 2021 by Chip Filson. Why America's Second Largest Credit Union Avoided Mergers. Jim Blaine is an iconoclast. CEO at State Employees Credit Union in North Carolina (1979-2016), he rarely followed the conventional business practices of his peers. His credit union model had one north star: improving.

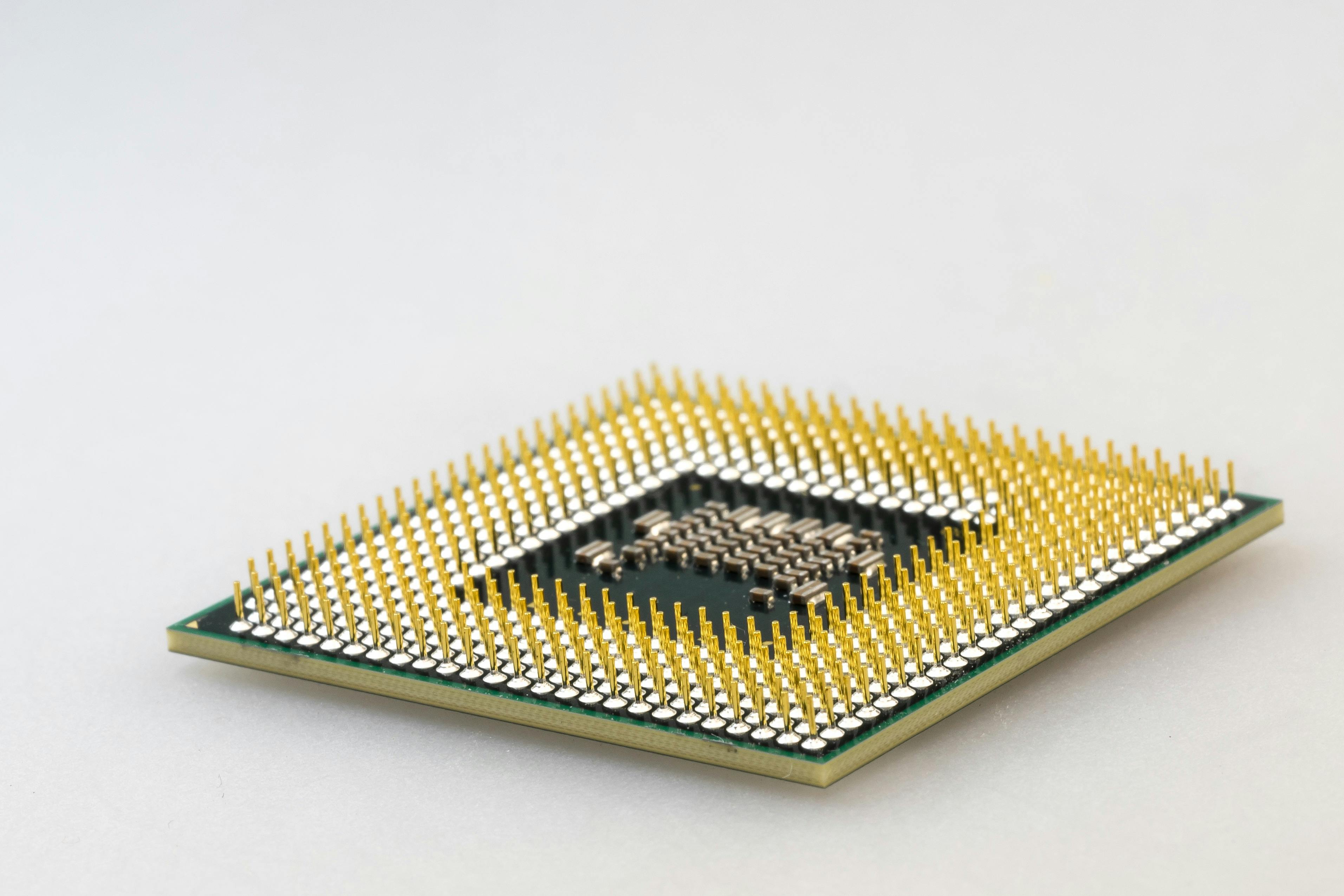

Free stock photo of chip, chipset, closeup

The letter was addressed to Charles Filson at my Wilmette, Il home, dated November 17, 1981. It reads in part: Chip: I'm sitting here in the in the Albany, N.Y. airport for my flight. I'll probably have many waits like this in the future. It gives me time to reflect. The past few weeks have been wild.

Just a Member Chip Filson

October 8, 2019 by Chip Filson, Just a Member. One of the critical qualities of leadership is the ability to rally support for vital issues through cooperation and example. When this leader is a.

Just a Member Chip Filson

Posted on February 28, 2023 February 28, 2023 by Chip Filson. Differing Outlooks for SECU's Future (Part II) At the October 11, 2022 members' Annual Meeting, SECU CEO Jim Hayes had been in his role since August 2021. He arrived with 25 years of senior credit union and NCUA leadership experience.

Chip Gabbey, Appleton, WI Real Estate Commercial Realtor RE/MAX 24/7

Chip Filson's Post Chip Filson Blogger at Just A Member - chipfilson.com 10h Report this post Improving an entire state's financial education possibilities. One State, a Credit Union CEO and.

Raymond “Chip” Moats Rosenberg & Ball Co, LPA

By Chip Filson. Chip Filson. On Jan. 26, 2022 I wrote a detailed analysis of the transfer of $10 million of members' capital to a nonprofit organized by the former CEO and chair of the now-merged Finance Center Credit Union in Stockton, Calif. My position was that this was an improper taking of funds owned by the members, but asked, "You be.

Just a Member Chip Filson

This Vote's Impact the Credit Union System. SECU is huge. At June 30 it reported $49.6 billion in total assets, almost 8,000 employees serving 2.8 million members in 275 branches. The first lesson from this vote is that one of the largest credit unions with members distributed throughout the state can successfully conduct a contested election.

Just a Member Chip Filson

News Credit Union Watcher Questions Transactions in Financial Center CU Merger Chip Filson calls on the NCUA to claw back a $10M transfer to a foundation, which he calls "a pilfering of members.

Chip Filson, Chairman of Callahan & Associates, to Announce New Vision

March 31, 2022. A former National Credit Union Administration official continued an ongoing series of blog posts raising concerns over credit union acquisitions of community banks. Latest Post: In his latest post, Callahan & Associates co-founder and former NCUA Central Liquidity Fund President Chip Filson said: Fear of missing out, or FOMO, is.