Fillable Form Rut75X Amended Aircraft/watercraft Use Tax

10 Credit for previously paid tax (see instructions) _____________. 5 Exempt or sale to On the line below, write the tax return number. nonresident of the Form ST-556 on which you previously If so, check the correct box below, and see instructions for Section 6. paid tax to an Illinois dealer.

Reg1 Illinois Business Registration Application Instructions Peggy

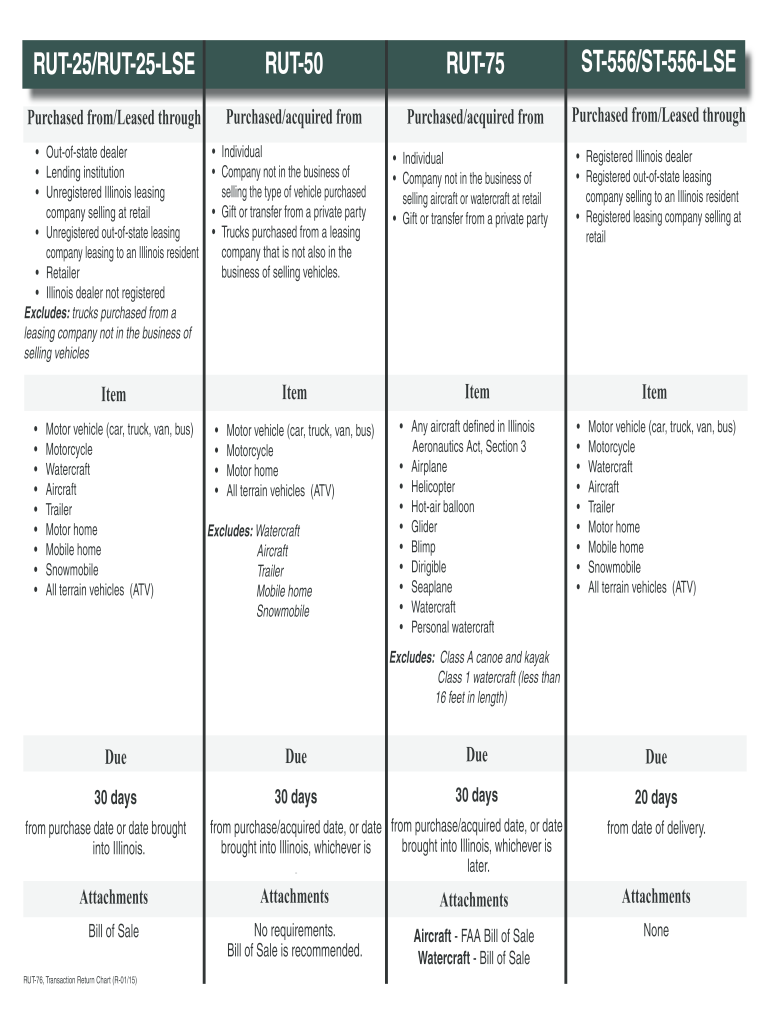

For example, the watercraft is purchased from an out-of-state retailer. This type of transaction is taxed and reported on Form RUT-25, Use Tax Transaction Return. If the watercraft is being leased and is brought into Illinois for title or registration, Form RUT-25-LSE, Use Tax Return for Lease Transactions, must be filed and taxes paid.

Form RUT75X (105) Fill Out, Sign Online and Download Fillable PDF

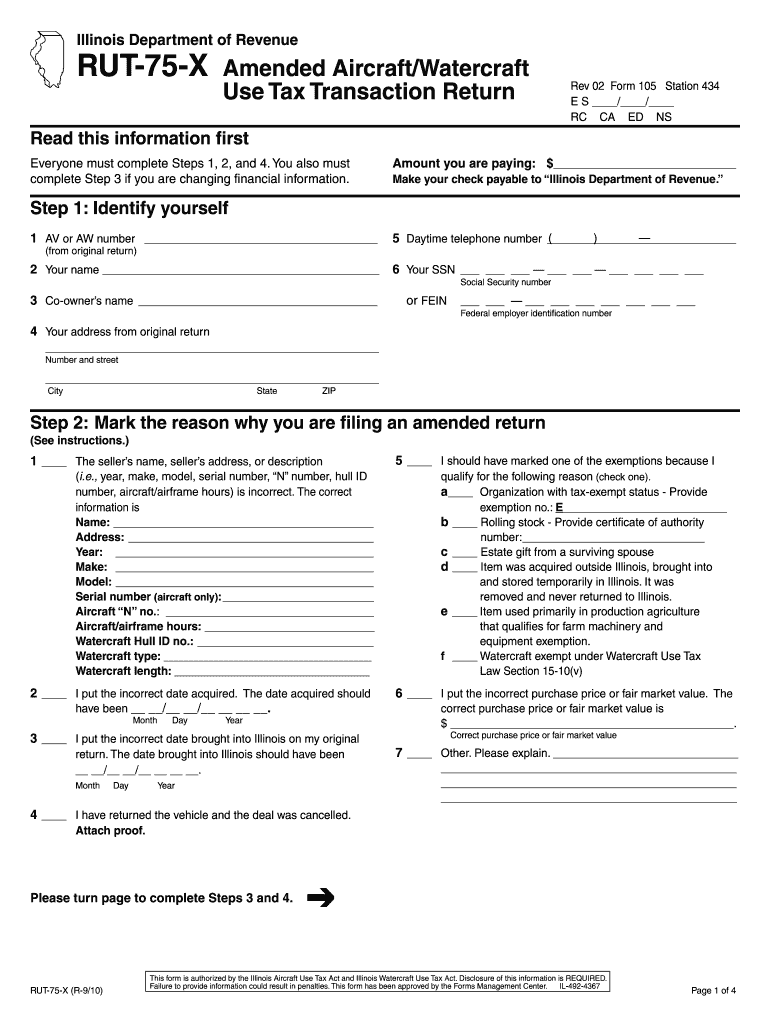

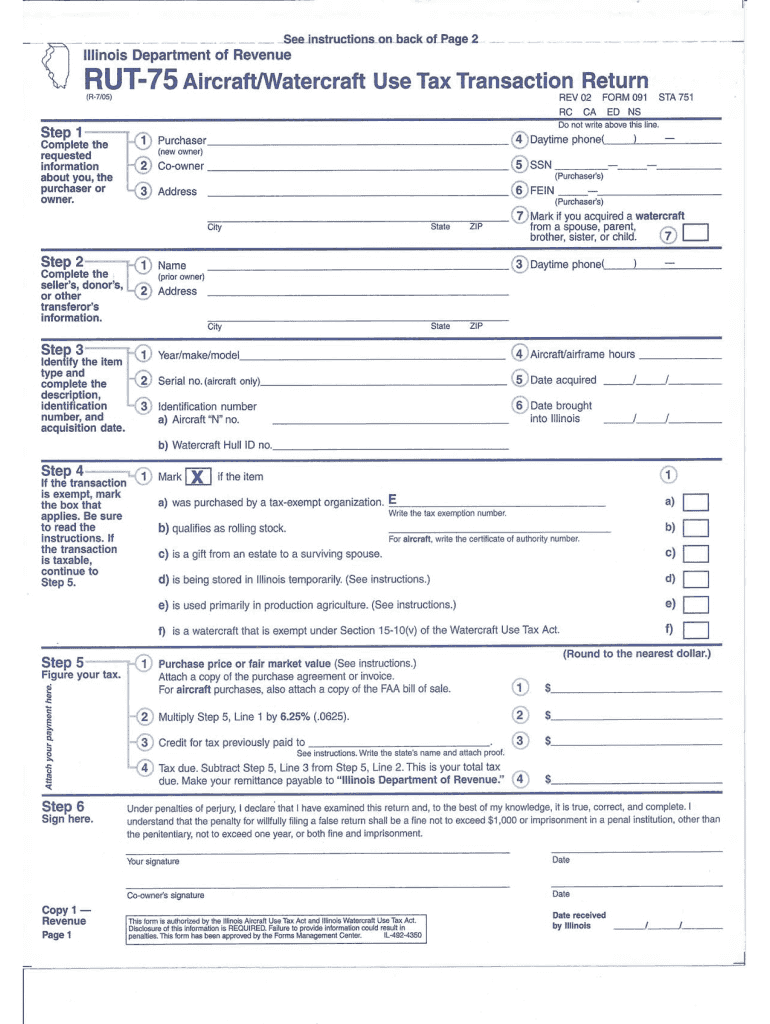

Form RUT-75 is due within 30 days from the date of acquiring the aircraft or watercraft if acquired in Illinois or within 30 days of bringing the aircraft or watercraft into Illinois if acquired outside Illinois. You must pay the tax or submit proof of tax payment or exemption before your registration will be issued by the.

2010 Form IL RUT75X Fill Online, Printable, Fillable, Blank pdfFiller

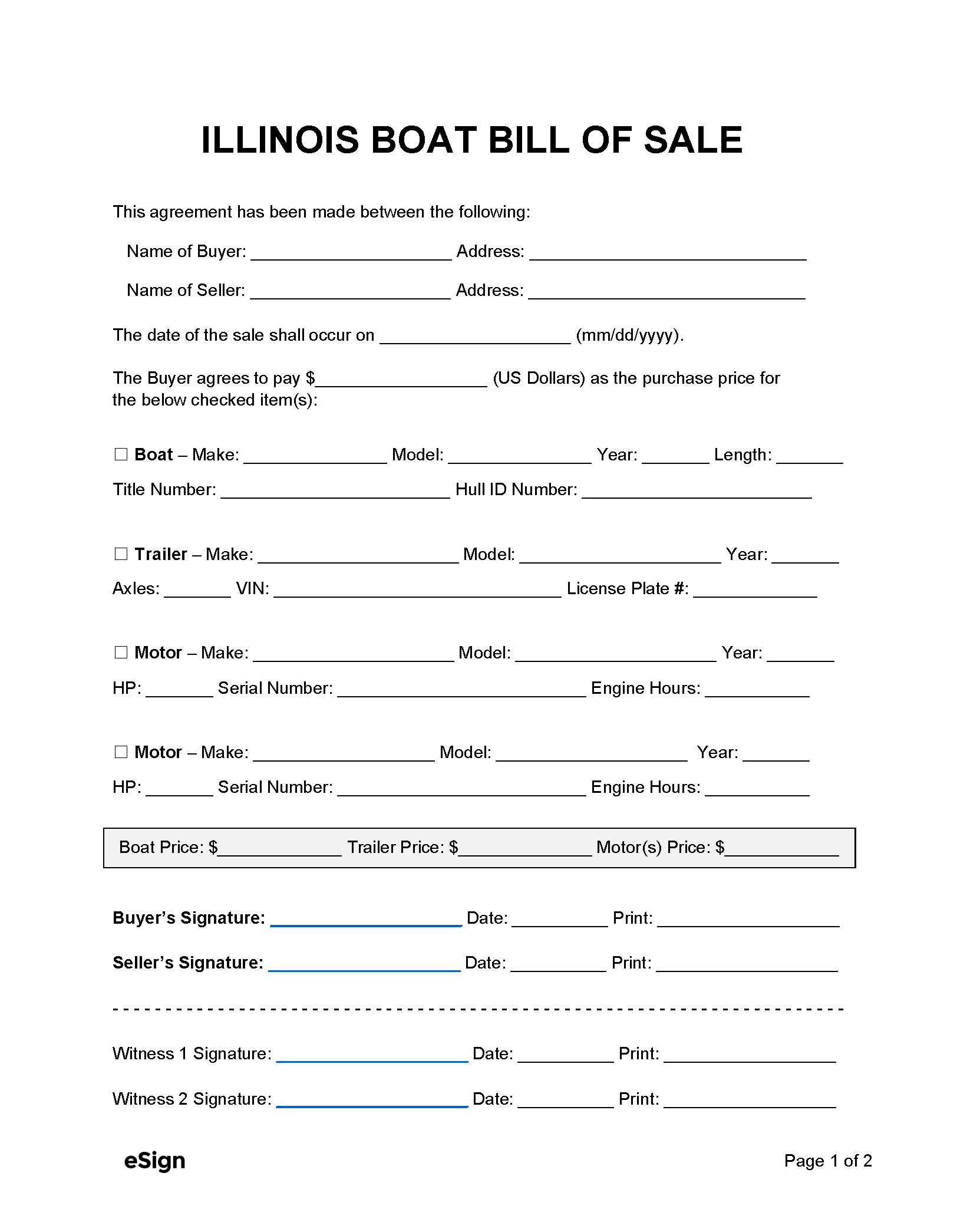

Completed Online Watercraft Application - check NEW box. Original out-of-state title (if titled) or registration card (if non-titling state) Electronic Payment for registration fees ( see fee chart) RUT-75 tax form. Copies of Bill of Sale or Purchase Agreement. Check or money order payable to Dept of Revenue for tax amount due.

Download Instructions for Form RUT75 Aircraft/Watercraft Use Tax

Form RUT-25 must be fi led by a person or business titling or registering an item in Illinois when the person or business purchased an item from an out-of-state dealer, other retailer, lending

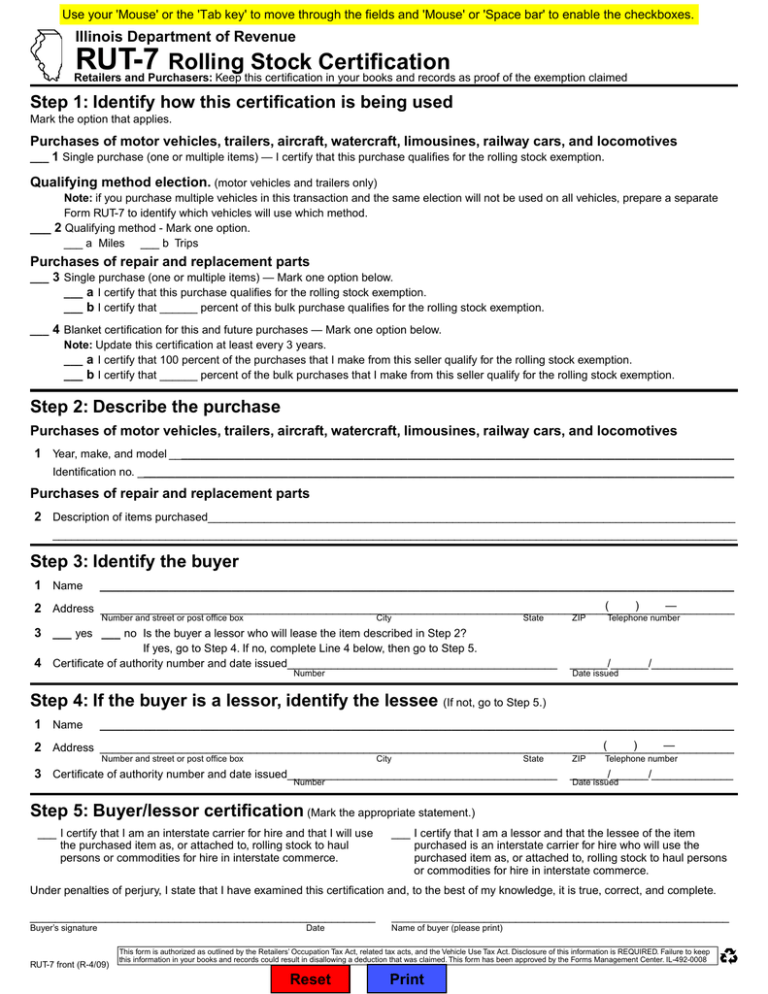

RUT7 Rolling Stock Certification

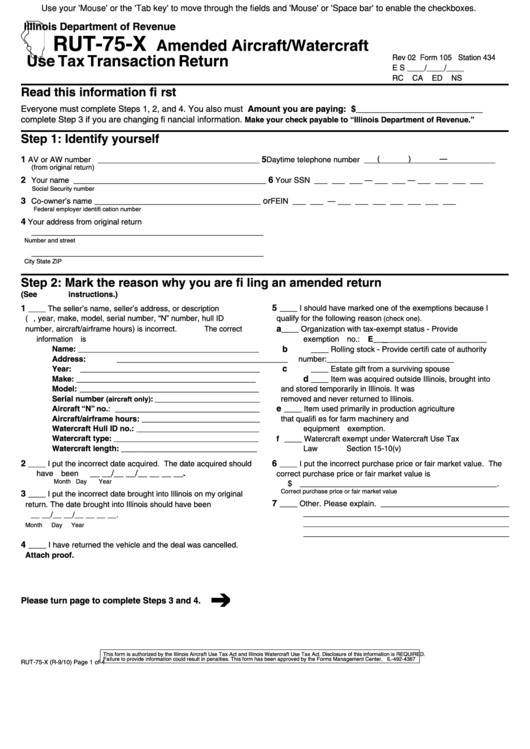

RUT-75-X (R-9/10) Page 1 of 4 1 ____ The seller's name, seller's address, or description. This form is authorized by the Illinois Aircraft Use Tax Act and Illinois Watercraft Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide information could result in penalties. This form has been approved by the Forms.

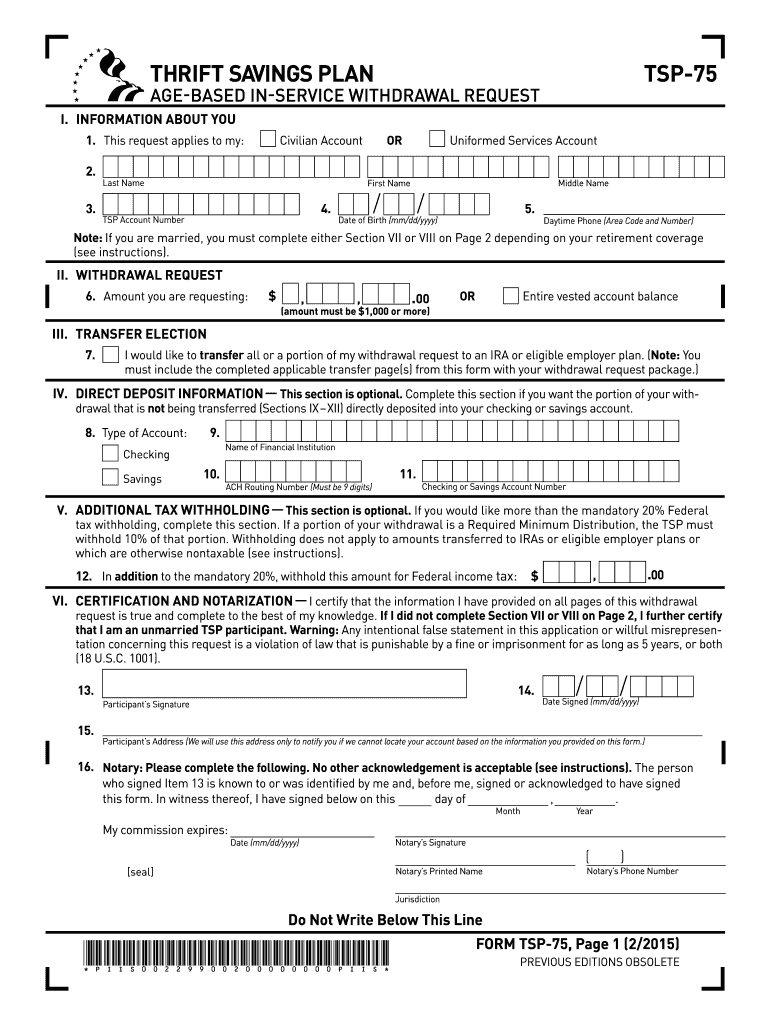

20152024 Form TSP75 Fill Online, Printable, Fillable, Blank pdfFiller

We review each transaction on a case by case basis. NOTE: To apply for a Corrected Title, Corrected Registration, Title Search or Dealer/Manufacturer registration, please call 217/557-0180 or 800/382-1696 to request a paper application. Used Watercraft - currently issued an Illinois registration number - Class 1 (jet skis/PWCs), Class 2, 3, 4.

Rut 25 20202022 Fill and Sign Printable Template Online US Legal Forms

Download Form Rut-75 Instructions Aircraft/watercraft Use Tax Transaction Return - Illinois In Pdf - The Latest Version Of The Instructions Is Applicable For 2022. See How To Fill Out The Aircraft/watercraft Use Tax Transaction Return - Illinois Online And Print It Out For Free. Form Rut-75 Instructions Are Often Used In The United States Army, United States Federal Legal Forms, And United.

IL RUT25LSEX 2015 Fill out Tax Template Online US Legal Forms

Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return, is due no later than 30 days from the date of acquisition or the date the watercraft is brought into Illinois, whichever is later if acquired by gift, transfer, donation, or non-retail purchase; or ;

Rut 75 Tax Form Fill Out and Sign Printable PDF Template SignNow

RUT-75. If you are amending a return that you filed before September 1, 2004, and do not know your AV number, leave this line blank. Write your name as it appears on your original Form RUT-75. Write the aircraft or watercraft co-owner's name, if applicable, as it appears on the original Form RUT-75.

Rut 75 Tax 20152023 Form Fill Out and Sign Printable PDF Template

Complete Illinois Department of Revenue (ST-556, RUT-25 or RUT-75) tax form and a check payable to IDOR. If paid electronically, please include a copy of the Verification page. Rut- 75 if purchased from an individual; if purchased from an out-of-state dealer then you would complete a Rut -25, or the Illinois dealer would complete an ST 556.

Free Illinois Boat Bill of Sale Form PDF Word

RUT-75 AircrafUWatercraft Use Tax Transaction Return (R-7/05) Step I Complete the requested information about you, the purchaser or owner. Step 2. You must file Form RUT-75, Aircraft/Watercraft Use Tax Return, no later than 30 days from the date of acquisition or the date the item is brought into Illinois, whichever is later..

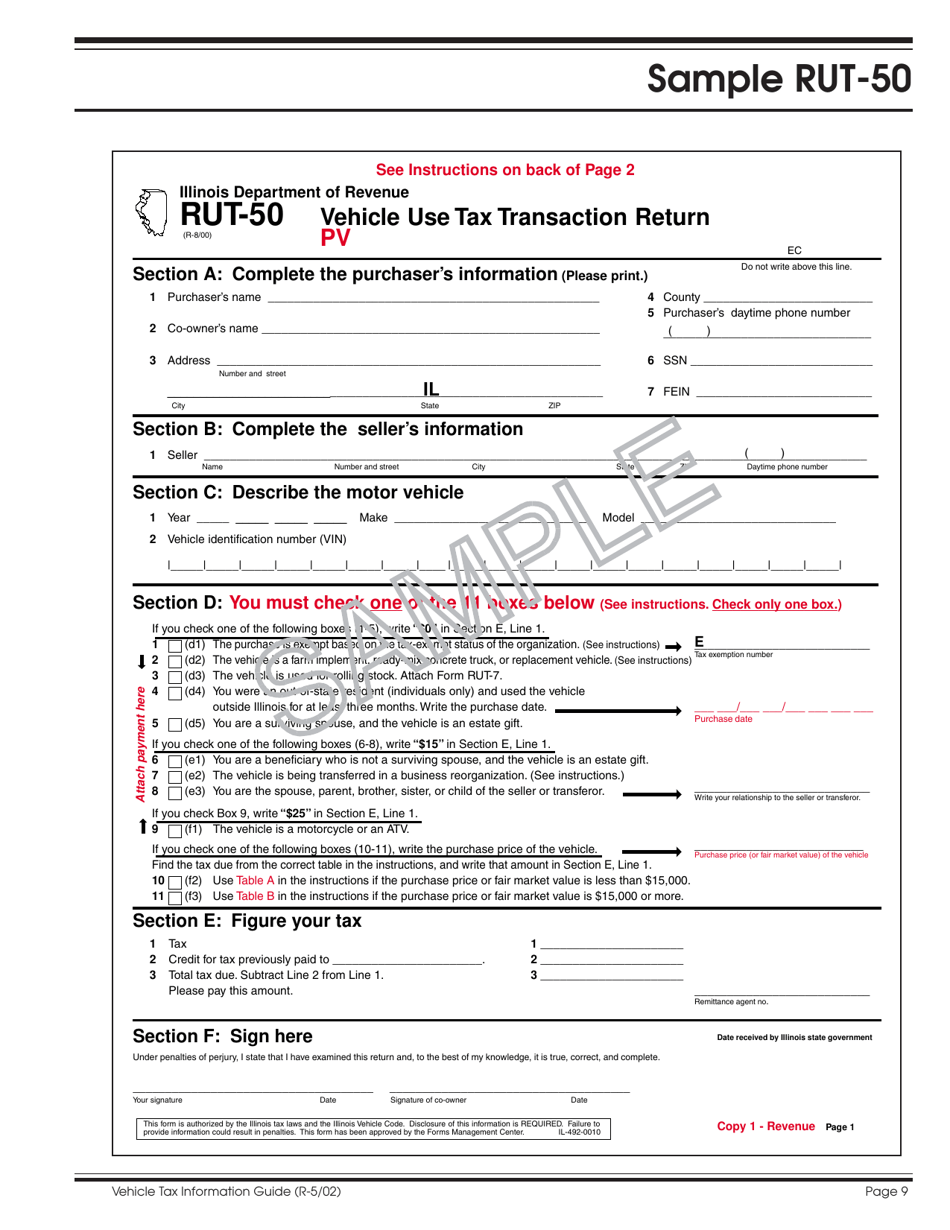

Sample Form RUT50 Fill Out, Sign Online and Download Printable PDF

RUT-75-X (R-01/24) Printed by the authority of the state of Illinois - Web only, One copy Page 1 of 2. This form is authorized by the Illinois Aircraft Use Tax Act and Illinois Watercraft Use Tax Act. Disclosure of this information . is required. Failure to provide information may result in this form not being processed and may result in a penalty.

2015 california form Fill out & sign online DocHub

Click on New Document and choose the form importing option: add Rut 75 form from your device, the cloud, or a protected URL. Make adjustments to the template. Take advantage of the top and left-side panel tools to modify Rut 75 form. Insert and customize text, pictures, and fillable fields, whiteout unnecessary details, highlight the important.

20172024 Form IL RUT7 Fill Online, Printable, Fillable, Blank pdfFiller

One of three forms must be used to pay tax or prove that no tax is due: Form RUT-25, Use Tax Transaction Return, due no later than 30 days after the date the watercraft or snowmobile is brought into Illinois or the date of purchase from an out-of-state dealer or retailer, lending institution, or leasing company selling at retail.; Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return.

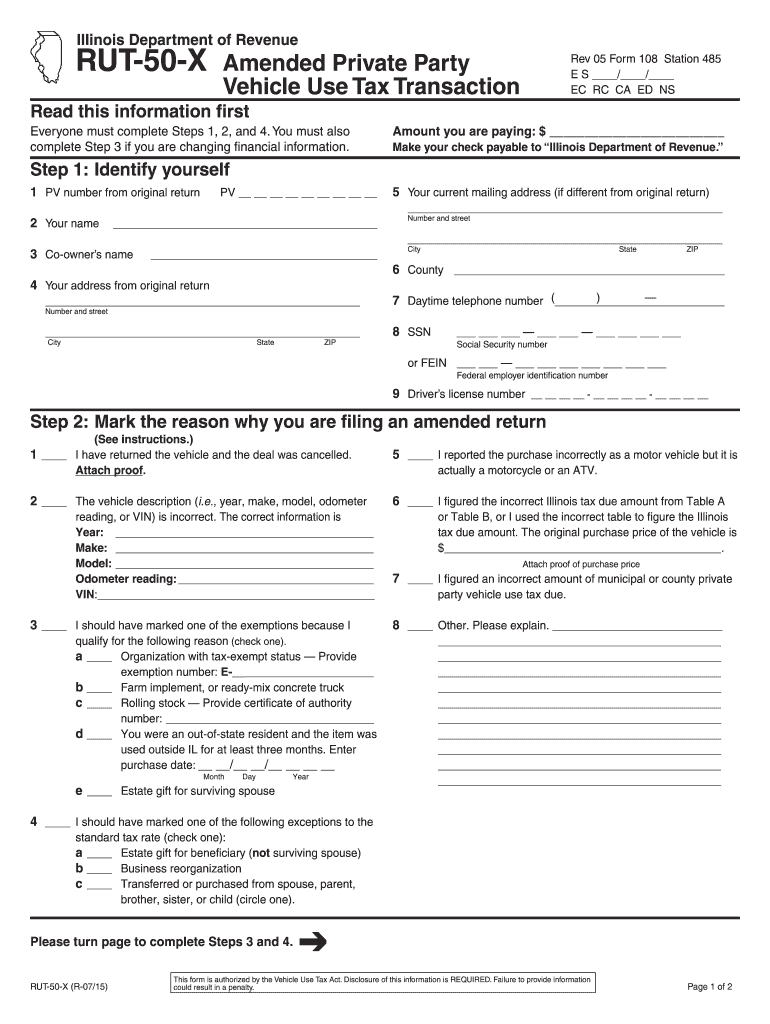

20152024 Form IL RUT50X Fill Online, Printable, Fillable, Blank

Do not use Form RUT-75 if you purchased the item from an Illinois dealer or leasing company. The Illinois dealer or leasing company must fi le Form ST-556, Sales Tax Transaction Return. If you acquired the item from an out-of-state dealer, lending institution, or leasing company selling at retail, you must fi le Form RUT-25, Vehicle Use Tax